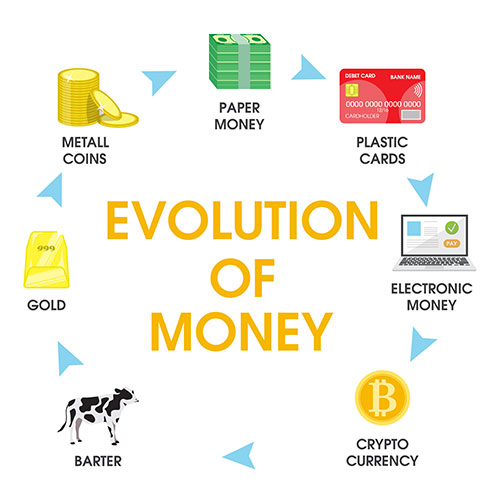

What is the real price of bitcoin?

Chinese bans show it is at least $31K now.

Image from: Pexels.com

Bitcoin recently received one attack from Elon Mask and two strong blows from Chinese government.

I pay not much attention to Elon Musk's announcement that Tesla will not accept bitcoins as payment for its cars on May 12, 2021. Nevertheless, after Mr. Musk's statement bitcoin fell from 57K on May 12 to 50K on May 13 and different articles titled "Elon brought down bitcoin with one tweet" appeared. That's not quite true, but it's the bad news for those who have recently invested in decentralized cryptocurrency.

The first strong blow came on May 18 - China has banned crypto exchanges and initial coin offerings, but had not barred individuals from holding cryptocurrencies so far. After that Bitcoin dropped from 45K to almost 35K. Besides the 2nd most capitalized cryptocurrency, ethereum, also fell from $3400 on May 18 to $2500 on May 20.

Bitcoin a little regained ground on May 21 and rose to 41K, but then came the second strong blow - Chinese authorities promised to crack down on mining and trading of the cryptocurrency. Bitcoin fell again to 35K as of May 21 and even lower to nearly 31K on May 23, but rose again to 38K on May 24.

So the total bitcoin drop within 12 days of May is 57K-31K=26K or about 45% which is a lot. This is a good example of the notorious volatility of the cryptocurrency. However, I think it is not a disadvantage, but an inherent attribute of the entry of a new currency into the market. Bitcoin and other decentralized cryptocurrencies "search" for their real price via demand, supply and various prohibitions.

..........

There is always a speculative component in the price of any financial instrument. Actually, the market is an instant reflection of participants' hopes (that they have bought a right thing timely) and believes (that they will sell it profitably) which is called "capitalization". For some reason, I subjectively thought that around a half of 55-60K bitcoin price was speculative demand and it turned out I was almost right. Two strong hits from the Chinese authorities stripped off bitcoin the speculative demand and exposed its real price.

It is at least 31K. Now.

..........

World-renowned economists say that cryptocurrency "has no intrinsic value" and is volatile too much.

It seems that they are right. It is said by respected professionals and the recent fall of bitcoin, etc. confirms their rightness. However, this is only a part of the truth. Professionals often see only what they have been taught to see.

1. Electricity and equipment for mining of cryptocurrency cost money - the mining of 1 BTC was at least $4K in 2020. Printing money or signing the decree to create USD or euro out of a thin air costs almost nothing. So what currency - decentralized crypto or conventional fiat money - does have intrinsic value?

2. Decentralized cryptocurrencies are traded in a really free market and only supply and demand form their price. No central bank or government can influence it. They may try to ban them or create their own cryptocurrencies , but governments cannot debase bitcoin or ethereum.

Governments all over the world have been constantly creating (and thus debasing) their fiat money, but lately they did that very actively because of the coronacrisis. Kristalina Georgieva, IMF Managing Director states that in 2020-2021 "... governments took exceptional measures—including about $16 trillion in fiscal action and a massive liquidity injection by central banks".

IMF does not say that all money in the world has become cheaper because of that injections since all fiat currencies are tied to each other and not secured by anything other than government decrees, but that is clear enough, isn't it? Especially for professional economists. Unfortunately, ordinary people don't think about these things, and professionals make their living in this market and obviously do not want to bite the hand that feeds.

..........

If the quantity of money with no intrinsic value is built up all money in circulation gets cheaper and the prices of all goods and services rise proportionally. This is already seen in food and fuel prices in the US.

Prices for materials and supplies are also going up globally - the World Bank stated in its press-release on April 20, 2021 that "Energy prices are expected to average more than one-third higher this year than in 2020, with oil averaging $56 a barrel. Metal prices are expected to climb 30 percent; and agricultural prices are forecast to rise almost 14 percent."

How does this happen?

People think of inflation as a natural occurrence like rain or snow, but it is a man-made phenomenon. Many governments are pursuing inflation targeting policy and all the world's currencies are devaluated by their central banks at a rate of more than 2% a year.

Yes, 2% a year sounds as not very much, but 2% annual inflation depreciates money 2.63 times (1.0249= 2.6388) in 50 years because of compounding effect, so your $100 has the same buying power as $263.88 fifty years later. The difference grows dramatically if the real inflation is more than officially targeted 2% a year.

In the US, most of money which was "dropped from a helicopter" (and it is around $569 billion) has flowed into the stock market over the past 6 months. It is more than invested amount of previous 12 years combined. Americans bought stocks instead of food or medicine, and thus stimulated the rising of price of food, materials and supply in the whole world because all economies are linked together through stocks, bonds and the world reserve currency - the US dollar. In this way the US "exports" its inflation to other countries.

..........

We live in time of globalization. Naturally, the inflation in a global world is global as well. It consists of the inflations of different countries and is managed by their central banks, which use the inflationary model of J. M. Keynes as a theoretical substantiation.

Governments have to justify their existence and somehow solve the problems of their countries by confronting coronavirus and other diseases, wars, poverty, climate change, etc. It turns out that governments and their leading economists know no other methods against economic crises than quantitative easing and "dropping money from a helicopter". So the US government is fighting the coronacrisis by actively creating trillions of dollars and thus impoverishing their own population. The bad thing here is that the Americans do not see the fact that Mr. Biden's signature on the American Rescue Plan Act of 2021 has created out of nothing and injected into the economy $1.9 trillion. In fact, every American became poorer at that moment.

According to some sources more than 3 trillion USD have been created by the US Federal Reserve just in 2020. Thus, the US dollar has been debased by around 20% in 2020 and therefore Americans were impoverished by 20% also.

..........

Predicting the price of bitcoin in the future is useless, but here is something I am sure of:

- Decentralized cryptocurrencies are by far the best (but insecure) store of value.

- All central banks (not only in authoritarian countries) will keep trying to ban or eliminate decentralized cryptocurrencies which are a very strong competitor to their depreciating fiat money. All central banks will eventually release their own cryptocurrencies and people will still be buying them even though they are just crypto versions of fiat money.

- Governments will not stop debasing their conventional currencies and all national elites will keep buying decentralized cryptocurrencies to protect their money from self-created inflation. Over time, more and more ordinary people will buy too, and the price of bitcoin, ethereum, etc. will generally rise, occasionally falling after central bank attacks like they did recently.

- The number of cryptocurrency thefts from personal accounts (wherever they are) and hacks of cryptocurrency exchanges will grow.

- All that will last until Internet exists.

..........

Elon Musk's decision and the Chinese bans hit bitcoin hard but I think that decentralized cryptocurrencies have withstood all that well enough, even though they have fallen by almost a half. In fact, bitcoin has been stripped all of the husk of speculative demand off.

So good news, bad news - who knows?

------------------------------------------------------------------

P.S. Dear Reader! I am very much interested in your opinion on the subject of this article. Please, write a comment or ask a question if you want to clarify something.

Yours,

Igor Chykalov

Comment

✚ Add comment