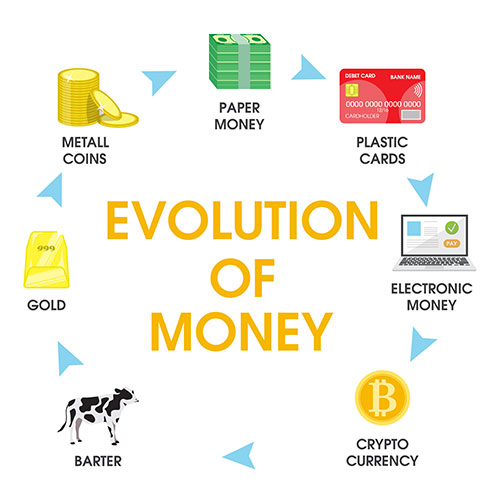

Cryptocurrency Is an Inevitable Step in the Evolution/Degradation of Money (part 5, excerpt)

Evolution of Money: from Reality to Virtuality and Then Back to Reality

Image from Shutterstock.com a little corrected by author

Since 2009 we all have been witnessing the beginning of a new kind of money - cryptocurrency. Everything has beginning and end. And everything has advantages and disadvantages.

The main advantages of bitcoin from my subjective point of view are:

- It is the decentralized cryptocurrency which is issued and verified by thousands of miners. Thus it cannot be debased by any central bank which makes it the best existing store of value. It is better than gold since the price of gold is affected by its global mining and use.

- The price of bitcoin depends solely on the balance of supply and demand on the market, it is not limited by anyone or anything.

- A "cap" of 21 million coins in circulation makes bitcoin a scarce currency and much sought after store of value which will just appreciate it.

- You can send any money to any user using your generated public and private keys. The network verifies the signature using the public key; the private key is never revealed. No mediators are needed and there is relatively low commission so far to send money (average transaction fee is $30.03 as for April 29, 2021). Transactions are well protected by cryptography, verified by a lot of users and irrevocably recorded using a public-accessed blockchain technology.

- No one can access the bitcoins in your account, only the owner of the private key (i.e. you). Or anyone who has it.

..........

Main bitcoin disadvantages are:

- Bitcoin is highly volatile currency, which is quite risky for buying and selling.

- If really only 0.5% of bitcoin wallets own 87% of all bitcoins ever mined (as of 16 March 2018), then yes, they can skyrocket the price of bitcoin, but that's what pure capitalism is about. Do not buy bitcoins if you don't want to. You can invest in gold, stocks or stablecoins instead.

……….

You have read an excerpt from the article. The complete series of articles "Cryptocurrency Is an Inevitable Step in the Evolution/Degradation of Money" will be available for purchase as a separate book on my website becomethyself.com in a while.

Comment

✚ Add comment