Who Is to Blame for the Banks' Failure?

Bank failures are either the result of the greed of bank management

or the monetary and fiscal policies of the government

and, ultimately, the people who elect that government.

or the monetary and fiscal policies of the government

and, ultimately, the people who elect that government.

On March 8, 2023 Californian Silvergate Capital, a cryptocurrency-focused bank, announced its intent to wind down operations and voluntarily liquidate the bank. On March 10, financial regulators have shut down the Silicon Valley Bank in Santa Clara, also in California. Bank customers were in panic, they couldn’t get their money back and were asking for help from the government. The country fears a domino effect and the fall of other banks.

Indeed, on March 12 the regulators announced that Signature Bank (New York) was taken over to protect its depositors and the stability of the US financial system. On March 17, San Francisco-based First Republic Bank, facing a crisis of confidence from investors and customers, has been set to receive a $30 billion lifeline from a group of America’s big banks.

Who is to blame for all that? As always, there are several levels of vision of the problem and, accordingly, several culprits.

It’s needed to see them all.

……….

Level 1 vision (from the closest distance): of course, the bank's management is to blame.

It seems that the collapse of Silicon Valley Bank is not likely to cause a crisis of the US banking system, since SVB failed because of a simple bank run, the timing of the announcement of SVB’s stock sale was wrong (a couple of days after Silvergate Bank announcement), i.e. it was a coincidence of unfortunate circumstances. Not really.

It can be said that the bank conducted its business in a risky way: it did not insure the client’s deposits and it kept its assets mostly in the form of loans and US Treasuries. When SVB bought the US Treasuries, interest rates were very low. Now the Fed has been raising the federal funds rate for over a year in its fight against inflation, so when the SVB needed cash, it sold its Treasuries at a loss of $1.8 billion. To plug the hole, SVB began an emergency sale of its shares on March 9 which collapsed 60% in value and all this had prompted the bank’s depositors (mostly rich startups and individuals) to urgently withdraw their money from the bank, which triggered a bank run at the speed of Twitter. Many SVB clients couldn’t make it in time. On March 10, the FDIC closed the SVB.

Interestingly enough, three hours before the closure, the bank's management received bonuses ranging from $12K to $140K for 2022. So they think they did a good job.

……….

Level 2 vision: the US regulators (the Fed, Treasury Dept.) are to blame.

They did not stress-test the bank and allowed SVB to risky invest the customer’s funds. In addition, the last call report of the bank showed that it held $209 billion in total assets, with $175.5 billion in total deposits, of which the bank estimated $151.6 billion (86.4 %) were uninsured. Banks often choose which financial cushion they need (or do not need, like SVB did): to insure the deposits by the FDIC (which is not obligatory) or to keep sufficient amount in the form of cash reserves to withstand a financial crisis.

This obviously has not been done.

……….

Level 3 vision: the US government (both major parties) and the Fed as a separate entity that manages country’s finances are to blame.

Senator E. Warren (D-Ma) states:

“In the aftermath of the 2008 financial crisis, Congress passed the Dodd-Frank Act to protect consumers and ensure that big banks could never again take down the economy and destroy millions of lives. Wall Street chief executives… spent millions trying to defeat it, and, when they lost, spent millions more trying to weaken it… In 2018, the big banks won. With support from both parties, President Donald Trump signed a law to roll back critical parts of Dodd-Frank. Regulators, including the Federal Reserve chair Jerome Powell, then made a bad situation worse, letting financial institutions load up on risk.”

The Dodd-Frank Act, which has been signed by then-President Barack Obama in 2010, created stricter regulations for banks with $50 billion and more in assets. These banks were considered “systemically important” and required to undergo an annual FRS’s stress test, to maintain sufficient capital and liquidity, and to file a “living will” plan for their quick and orderly dissolution if they had to fail.

The 2018 rollback increased the $50 billion threshold to $250 billion. When Silicon Valley Bank collapsed many observers argued that the lack of regulatory scrutiny played a key role in the bank's failure.

……….

Level 4 vision: the US government deceives its citizens.

The US is a capitalist country, isn’t it? Or not really?

If the US is a capitalist country with a free market, then let SVB and other failed banks go bankrupt. Maybe someone buys them. The regulators (FDIC) are obliged to return up to 250 thousand FDIC insured deposits (86% of SVB deposits were not insured) and that’s it, but not to bail the problematic banks out. The customers will suffer, yes, but under capitalism it's every man for himself. There are more entrepreneurial freedom comparing to socialism, more earnings, but also more risks.

Now the federal officials are trying in every possible way to emphasize that they would not use taxpayer money to repay the companies – former failed bank’s clients, the money will instead come from a mix of the failed banks’ assets and from a broader insurance program financed by other banks.

Maybe. However, the US government has often bailed out troubled banks at taxpayer expense.

Investopedia thereupon notices: «Ironically, sitting Republican presidents took actions during the S&L crisis (1980-1995 – I.C.) and the subprime debacle of 2008 that contradicted their free-market rhetoric, largely in the form of big government bailouts for failing financial institutions.»

It turns out that the people of the US bear the burdens of capitalism, while the banks and their managers, in particular, enjoy the privileges of socialism. This is unfair.

Besides, the Fed can always just create the right amount of money out of thin air to help the banks. This would spur inflation, yes, but it is already out of a control.

……….

Level 5 vision: human nature is to blame (which means no one).

People in Santa Clara are saying about the greed and avarice, reigning in Silicon Valley. Big money can only be made through high risk and/or responsibility. It seems, the SVB took a risk and failed.

Barnett Frank, ex-member of the House of Representatives, a democrat and co-sponsor of the above-mentioned 2010 Dodd–Frank Act, pushed to ease financial regulations after joining the Signature bank Board.

That’s it. In money we trust more than in God.

By the way, Investopedia explained in a simplified, but clear enough way the visible part of the 2007-2008 financial US crisis and also mainly blamed human greed and lack of control over banks by financial authorities:

“Broadly speaking, it was caused by greed-driven behavior and lax oversight of financial institutions. The loosening of financial industry regulations in the decades leading up to 2007 allowed various types of institutions in the US financial services industry to lend money in ways that were riskier than ever before. The housing sector in particular experienced massive growth that couldn't be supported. The bubble burst, sending the banking industry and global stock markets into a downfall. It created the worst global recession in generations.”

……….

Level 6 vision: it's the fault of 1) the Fed with its wrong monetary policy, which creates financial crises; 2) the US government with its short-sighted fiscal policy which incurs debts and 3) the people of the US who blindly elect the US government and allow it and the Fed to act in this way.

The Fed is constantly interfering with the US financial system by changing the federal funds rate to stimulate demand over supply, following its flawed inflation targeting policy. A decrease of the federal funds rate makes loans cheaper. Then the people actively take loans and buy houses and cars, thus stimulating the economy. However, the Fed creates money for loans out of thin air, thus creating 1) the hidden inflation, and 2) economic crises, which it then heroically fights, flooding the economy with the next money created out of nothing. It looks like putting out a fire with gasoline. It is a vicious circle. I think that all the financial crises in the US during 20 and 21 centuries were provoked by the state interference (namely the Fed and the US government) in the US financial system, and with the deepening of globalization - in the world finances, because the US dollar is the world's reserve currency.

In the above quote, Investopedia simplifies the problem, blaming just the bankers' greed and lack of regulatory oversight of banks before the 2007-2008 financial crisis. In fact, it all started with the Fed's desire to stimulate economic activity in the country in the 2000's, and then the “greed-driven behavior and lax oversight of financial institutions” stepped in.

I have to give here a big quote about the real cause of the 2007-2008 crisis from an earlier article of mine:

“The housing bubble at the US real estate market began to inflate because the Fed wanted to increase economic activity in the country. From 2001 to 2003 the federal funds rate went down from 6.4% to 1% and many Americans rushed to take cheap loans (mortgages) to buy houses. Real estate prices in the US soared and the Fed as the main regulator of the financial market hadn’t controlled the banks which were engaged in blatant predatory lending. Mortgages were often given to people who were not creditworthy: in 2004 69% of borrowers were from subprime lending.

By 2006 the Fed raised the federal funds rate to 5.25%, the real estate market saturated (real estate prices can't go up forever), and borrowers with adjustable-rate mortgages have found that they owed more on their 2001-2005 mortgages than their homes were worth in 2006. There were many such people, they were unable to repay their mortgages, and the banks began to seize their homes through foreclosure procedure and put them up for sale at dumping prices. Real estate prices in the US collapsed.

Mortgage-backed securities (MBS) tied to American real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide who invested in those instruments have suffered severe damage especially with the bankruptcy of Lehman Brothers Investment Bank in September 2008, and a subsequent international banking crisis started.”

……….

A similar scenario unfolded during the US banking crisis 1980-1995, also known as the “Savings and loan crisis”. 1617 commercial and savings banks failed then.

Investopedia describes the cause of that crisis as follows: “The changes in regulatory and economic environments induced unrestrained real estate lending beginning in the late 1970s and continuing throughout the early 1980s. Many analysts consider this to be the primary cause of the banking crisis of that time. Severe economic downturns in the early 1980s and early 1990s, as well as the collapse in real estate and energy prices during this period, were both outcomes and key precipitating factors in an increasingly unstable financial environment. Fraud—primarily looting or control fraud—and other types of insider misconduct played a major role in the overall crisis, as well. “

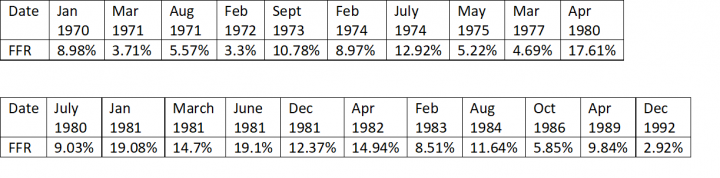

It’s again a simplified point of view. To complete the picture, I can add that in the 1970’s the Fed has made a real financial swing for the economy and the federal funds rate (cheap loans/expensive loans, i.e. stimulating/inhibiting the economy) was changing sharply:

It's like driving under the influence a car with faulty brakes and it's not surprising that 1617 commercial and savings banks have failed at that time.

By comparison, before the financial crisis of 2007-2008, the Fed lowered federal funds rate once from 6.51% in October 2000 to 1.00% in April 2004 and raised it again to 5.25% in August 2006.

FYI: the last time the Fed has lowered federal funds rate from 2.4% in July 2019 to 0.05% in Apr 2020, held it at around 0 until March 2022 and raised it again to 4.57% as of Feb 2023. Now, after the troubles with SVB and a few other banks the Fed will probably be wary of raising federal fund rate any further for a while.

……….

And a few more words about the famous crisis of the 1930s, the Great Depression.

Milton Friedman, a great American economist, wrote a lot about the Great Depression and argued that “the Depression had been caused by an ordinary financial shock whose duration and seriousness were greatly increased by the subsequent contraction of the money supply caused by the misguided policies of the directors of the Federal Reserve.”

Ben Bernanke, a chairman of the US Federal Reserve 2006-2014, told after at the University of Chicago event honoring Milton Friedman’s 90th birthday:

“Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression, you're right. We did it. We're very sorry. But thanks to you, we won't do it again.”

I trust Mr. Bernanke’s words about the Fed’s role in creating the Great Depression, but they obviously keep doing “it” again.

………

All six levels of vision have the right to exist and they all seem right. Then it turns out that all market participants are to blame for the current financial situation in the country, i.e. it is a system failure of the USA as a state. If the current failure of SVB and other banks does not lead to a big banking crisis, then some of the next ones will do surely. The Fed's monetary policy (stimulating the economy) and the government's fiscal policy (the country's budget deficit) will not change, and the people will keep blindly electing their governments from two major parties with no real vision and thus correct choice. No one knows when the next financial crisis comes, including the Fed, which has been created to maintain “the stability of the financial system”, and “stable prices, including prevention of either inflation or deflation.”

.……….

There is also a level 7 vision - what is going on with the world's financial system.

So far, the US has "exported" its financial crises to other countries due to the exceptional role of the US dollar, but I think the world community will soon abandon the USD as the reserve currency because of its constant depreciation.

And more than that: what would all the US dollar holders in the world do if the Fed suddenly decides to switch to another currency? I have been hearing the name "amero" already for a long time. These are the beauty and the problem with fiat money – governments can easily add (creating inflation) or reduce (creating deflation) them in the circulation, devalue them, or abolish them altogether. Fiat money is very easily manipulated, unlike decentralized cryptocurrencies, that’s why Satoshi Nakamoto has created the alternative - bitcoin.

The global financial system has lost its foundation after the detachment of the USD from gold in 1971 during so-called “Nixon shock” and suffocated from the influx of fiat surrogate money, which do not saturate the economy. Central banks of different countries follow a flawed inflationary development model of J. M. Keynes and constantly increase the money supply, thus creating the hidden inflation and devaluing national currencies.

The foreign exchange market is a free trade of virtual symbols ($, €, £, ₣, ¥, etc.) which are backed only by the obligations of the governments to accept these symbols as means of payment. This market is regulated by supply and demand, so a bunch of fiat national currencies with relative value are linked together by relative exchange rates and just floats around somewhere in virtual bank space with relative purpose or meaning, being basically detached from any kind of absolute value like gold, oil, food or land because of the constant depreciation. Let me remind you that the meaning of existence of money is to be medium of exchange, unit of account, store of value and (the derivative) standard of deferred payments.

It is a global financial system failure, not just in the US.

……….

There should be also others and more comprehensive levels of vision.

……….

Famous investor Michael Burry, a founder of the hedge fund Scion Asset Management, has recently answered briefly and clearly the question “who is to blame for the banks' failure” in his Twitter: “2000, 2008, 2023, it is always the same. People full of hubris and greed take stupid risks, and fail. Money is then printed. Because it works so well.” Then he deleted his tweet though.

This article is basically about the same thing, only bigger in volume.

So, let’s wait for the next systemic crises which are bound to happen. One of them will at some point collapse the existing system in the US. Maybe it will be another banking crisis, maybe the bankruptcy of the federal government comes first.

……….

P.S. Yes, it is boring to figure all that out, and it seems that there are more important and interesting things to do. However, if the Americans are not going to deal with that, then who? And, if not now, then when?

Comment

✚ Add comment