Yuan as the Second World's Reserve Currency

Global trust in the USD is melting. The main enemies of $ are the Fed-made inflation,

mismanagement of the US banking system and political turmoil in Washington.

Financially and politically, Chinese yuan is more stable.

mismanagement of the US banking system and political turmoil in Washington.

Financially and politically, Chinese yuan is more stable.

Image by Eric Prouzet on Unsplash.com

Hidden inflation is an increase in money supply in an economy which is being made by the central banks, following their “inflation targeting” policy. Hidden inflation causes a devaluation of the national monetary unit. If that unit of currency is used as a means of payment in other countries or for international trade, it undermines the economies of other countries because of the unequal exchange of goods and services.

Such unit of currency is also useless as a store of value because of its constant depreciation.

Apparent inflation is created by an excess of demand over supply (or a decrease in supply) of some goods and services, i.e. their shortage in some special circumstances (war, natural disaster, epidemic, speculation, insufficient production). It is actually force majeure or act of God.

Those two types of inflation are different and should not be confused. Ordinary people do not notice the difference between the two. Governments and economists prefer to put all the blame on God and I have always wondered whether they did that deliberately or just because they had not a clue.

……….

The mechanism of creation of hidden inflation.

Any amount of extra money, having been put into circulation in printed or electronic form (as loans), depreciate all existing money in a country by the amount of additional money issued, because neither services nor goods were really added by this emission. That’s why I call such money “empty” or “surrogate” money. Someone takes this extra money as a loan and buys something with it. This artificially creates an additional demand of goods and services which raises their prices. That’s why everything in the country will be a little more expensive after a while. In March 2023 the official annual USD inflation rate was 5% which meant all goods and services in the US costed on average 5% more than in March 2022.

Inflation targeting policy pursued by central banks in many countries is actually a one-way road to nowhere and it is surprising that almost all countries including developed capitalist ones, are heading to the abyss, despite their "free self-regulating markets". It turns out that these markets are not "free" and "self-regulating".

All loans around the world now are created out of a thin air and fill the economies with superfluous "empty" money. For example, the Fed has issued almost $6 trillion of additional money from January 2020 (M2=15.4 trillion) to December 2022 (M2=21.2 trillion). This means that all existing in 2020 US dollars in the whole world have been devalued by 37%. That's why prices in the US are creeping up and will keep doing so.

This is the mechanism of creation of hidden inflation at work, which is constantly used by central banks around the world. They use it to artificially create an excess of demand over supply and fight unemployment. Living on debt is now considered “smart” and many "smart" people, businesses, and countries follow this path.

When inflation exceeds the targeted 2% a year, the Fed begins to slow the economy down by increasing the federal funds rate. Then loans become more expensive, people borrow less and buy fewer goods and services. However, if the Fed slows the economy down too much, unemployment increases. 5% inflation rate in the US in March 2023 is lower than in all previous months, but this should not be misleading - the inflation will not stop there because too much extra money has been emitted over the past 2 years.

……….

Hidden inflation in different countries and fiat money.

Here are examples of inflation in different countries for comparison: euro has fallen in price by 6.9% since March 2022, British pound – by 10.1%, Turkish lira – by 50.5% (!). Against this background, the Chinese yuan looks very good - during the same period of time it has dropped only by 0.7% despite the fact that the Chinese economy is a mixed socialist market economy.

All the world's currencies are now fiat money, i.e., they are backed only by decrees (promises) of the governments and based just on faith of the holders that the governments will not devalue their money. However, all countries abuse their ability to issue "empty" money, and the US abuses its monopolistic status of the only country that has the right to emit the world reserve currency.

The Fed has essentially become the world's main counterfeiter.

……….

China also creates its own crises, but it gets out of them quickly.

Inflation in China for the last 10 years is much lower, than in any other country in the world, hovering around 2% per year (except for a spike in 2020 to 6%, which I will discuss below). That means the yuan is more stable than any other currency in the world and the People's Bank of China is doing better than the Fed, European Central Bank or Bank of England. China, apparently, has recently become uninterested in working in USD since the country is actively reducing its holdings in the US Treasury Securities.

However, the Chinese also do stupid things and periodically inflate bubbles in their market.

For example, in 2020-2022 a crisis in China's real estate sector has happened - one of the major real estate developers “Evergrande” incurred debts of more than $300 billion and almost went bankrupt.

This happened because of the excessive craving for the borrowings. “Evergrande” took loans, built apartment buildings and did not sell them, but took loans again to faster build new ones and again borrowed money for the next projects, i.e. the borrowed money didn’t return into circulation. Thus lending banks constantly injected into the Chinese economy considerable superfluous money as loans. “Evergrande” created a construction boom and inflated the financial bubble in the Chinese real estate market for more than 300 billion dollars. This, in particular, raised the inflation in China from around 2% in 2019 to 5.5% by 2020. Chinese authorities responded by banning further lending to the developers, and the bubble burst. “Evergrande” had no money and the company began to sell off its buildings. Many Chinese bought housing from “Evergrande” as an investment and could not sell them. As a result, millions of apartments now stand empty and sales of new homes in China plunged 47% in April 2022 comparing to a year earlier.

This is a very good example for understanding how construction company or bank can inflate a financial bubble in a country by just issuing loans. The US has tasted something similar in 2002-2006, only then the banks provided mortgages to the people for buying real estate, which led to the Great Recession 2007-2009 and became a significant precondition for multi-year European debt crisis later.

……….

A coalition is being formed to promote yuan as the second world's reserve currency.

The yuan’s share of global foreign exchange reserves is more than modest now - around 3% of the global total. But …

The Russians suggest to conduct settlements between the BRICS countries (Brazil, Russia, India, China, and South Africa) in yuan. China silently supports this point of view. India is already buying coal from Russia for yuan. Brazil and China recently agreed to use yuan in cross-border trade. China has also been setting up yuan-clearing arrangements with Pakistan and Argentina. Saudi Arabia considers accepting yuan instead of USD for selling oil to China…

Extreme circumstances exacerbate all problems. In 2020 COVID-19 shook the foundations of our civilization, now it is the war in Ukraine. The Russians are under Western sanctions for unleashing the war and it is certainly good for them to trade in yuan. The BRICS countries together have already surpassed the G7 states by GDP and they didn't want the US to devalue their money. Neither does Saudi Arabia.

A fairly strong coalition of countries is being formed now which wants (and actually is able) to raise the yuan to the level of the world's second reserve currency.

……….

The US does not like all this, despite its declared commitment to competition. Many developed countries probably don't like it either, but no one wants their dollar reserves to depreciate all the time either. Perhaps that is why global currency reserves in USD decreased from 72% in 1999 to 59% in 2022.

However, the assets of various countries in euros, pounds, francs, Canadian dollars, etc. are also depreciating because central banks of all countries are also constantly emitting their currencies. The US dollar is still the world's reserve currency only because there is no better replacement for it and few want to depend on authoritarian China, which will use its yuan to put pressure on other countries. But the US also uses its currency as a weapon, occasionally excluding by sanctions from the world economy, for example, Iran since 1979 (not always fairly), or Russia in 2022 (absolutely fairly).

What to do, everyone uses whatever they have to achieve their goals.

So far, the governments of various countries have had to put up with the unique status of the US dollar.

……….

The US dollar is harmful as the world's reserve currency.

Unfortunately, almost no one in the US or elsewhere in the world is interested in understanding of the nature of hidden inflation. Most economists in the world belong to the Keynesian school of economics and support the policy of "targeted inflation" because they simply do not know any other.

The Fed constantly issues backed with nothing money, driving up the inflation and devaluing the US dollar, and then it fights the consequences of its actions by raising the federal funds rate that sometimes lead to the failures of fairly large regional banks. By doing that, the Fed is undermining not only the US economy, but also all the other economies in the world which hold some of their assets in the US dollars and securities.

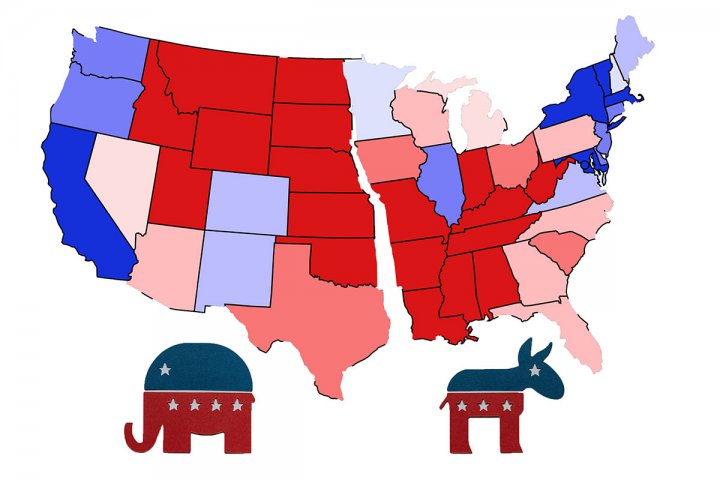

The US government does not want to deal with inflation, relying entirely on the views of its professional economists and the Fed, but it brings chaos to the global economy by constant political confrontation between Democrats and Republicans, in particular, on the issue of raising the ceiling of the national debt. The latest news on the subject is disappointing – the Republicans, which control the House, do not want to raise the national debt ceiling without putting the restrictions on budget spendings.

Let me remind you that the US may go bankrupt in June 2023, if two major parties do not agree on the issue. The bad thing here is that even if they do reach an agreement now (which is likely to happen), the financial collapse of the US is just postponed for a while. Since the US dollar is the world's reserve currency, a default of the US federal government will hit all countries and cause a bigger global financial crisis than the Great Recession of 2007-2009. This is the sword of Damocles hanging over the head not only of Americans, but of all mankind. Obviously, no one wants to depend on the whims of politicians in Washington.

All this together makes all investors to look for alternatives to the USD. The political confrontation between RP and DP together with hidden inflation greatly undermines the credibility of the USD, which (like any fiat money) is based only on trust. Global trust in USD is melting. George Yeo, former foreign minister of Singapore says: “The US dollar is a hex on all of us. If you weaponize the international financial system, alternatives will grow to replace it and the US dollar will lose its status.”

Now the tipping point is coming and the Chinese yuan will become the second world’s reserve currency in the near future.

……….

Everyone badly needs a stable, apolitical and convenient universal equivalent for easy mutual settlements and storing of value.

The US dollar fails in this role because of its constant depreciation and the political mess in the US. And any other currency in the world does. The Chinese yuan, too, is depreciating at an average speed of about 2% a year. So something else has to be maken up. And different countries are making it up.

For example, Singapore and Thailand have connected their real-time fast payment systems “PayNow” and “PromptPay” in 2021, enabling customers of participating banks to transfer funds between the two countries in local currencies. In November 2022, Bank Indonesia, Bank Negara Malaysia, Bangko Sentral ng Pilipinas, Monetary Authority of Singapore, and Bank of Thailand have signed the agreement to link their fast payment systems, bypassing the need to use either the dollar or the Chinese yuan for cross-border transfers.

In addition, Bitcoin and other decentralized cryptocurrencies exist already for a good dozen years. They are designed to be a stable, apolitical and convenient universal equivalent for easy mutual settlements and storing of value. They are, however, still considered a dangerous investment, despite their undeniable advantages: they are backed with real labor (real money spent on their creation, not just another money emission of the central bank), there is a cap on Bitcoin’s circulating supply of 21 million coins (which means no inflation), they are managed by the community of users, are completely apolitical, and no government is able to devalue them. Bitcoin and other decentralized cryptocurrencies are as virtual as fiat money are - now they all are just symbols at your bank account or cryptocurrency wallet, there is no difference.

There are disadvantages, of course, also and the main one is not the volatility of cryptocurrencies (the market just keeps setting their real price) or the risk of frauds, but the fact that 9.62% of bitcoin addresses own 98.51% of all bitcoins ever mined as of December 2022. If humanity switches to bitcoin, for example, then those 9.62% of humanity becomes the new world elite and will be able to rock the economies of different countries (if they agree that among themselves). The current world elite cannot allow that. They will try to ban bitcoin and all decentralized cryptocurrencies, or dissolve them in a big amount of Central Bank Digital Currencies (CBDCs), which is already being done little by little.

People don't see that CBDCs are the same fiat depreciable money and will be buying them because of alleged bank’s “reliability" (see the recent demise of one of the global biggest Credit Suisse Bank) and bank’s "guarantees” (see the recent failures of Silicon Valley Bank, Signature Bank and First Republic Bank).

We are witnessing the beginning of global financial USD-based system failure and the main reason for that is the constant emission of "surrogate" money made by all central banks, not just the Fed. Fiat money is constantly losing its intrinsic value and thus the US dollar has failed to be a reliable global reserve currency.

……….

To make any currency a real world reserve currency, you just need to peg it to one or more physical commodities (e.g., gold, electricity, oil, gas, grain, water, or land) and not allow any additional emissions. After a while, this currency will begin to appreciate (or rather, all other currencies will depreciate in value relative to it) and both governments of other countries and average citizens will gladly buy it. There is a huge advantage here - humanity will once again have a stable and, God willing, convenient universal equivalent, a stable basis for mutual settlements and storing of value.

There will be, of course, disadvantages also. For example, if a small country tries to do that, all of its currency will quickly be bought up and it will have to resort to emitting its currency again, i.e., inflation. In addition, any country with stable currency will experience problems exporting its goods - they will be more expensive than all other similar goods on the foreign markets, because their price is denominated in a hard currency and tends to raise.

From those points of view bitcoin is better. Maybe that's what some optimists have in mind, predicting bitcoin’s rise up to $100K or even $1M per coin.

The pessimists spoke last year about Bitcoin falling to $13K.

The truth is as usual somewhere in between. In the beginning of May 2023 BTC costs around $29K. It seems it is its fair price as for now until something special happens – like the US federal government default which is now scheduled on June 1, 2023.

……….

Socialist China offers capitalist America a fair competition.

The US dollar has been ruling the world's financial market in a monopolistic way for many years and simply needs competition to be improved. The Yuan also wants to be the world's reserve currency and it has as many reasons for that as the US dollar does - the world's 2nd economy, advanced technologies, financial and political (!) stability, a huge population, military power, political will of one party to dominate the world and the authoritarian power to quickly implement its decisions.

China offers a fair competition, something Americans have always advocated for. The Russians help China a little in this, not noticing that financially they are becoming a part of China. Well, that's their own business.

……….

An interesting statement is attributed to former US Treasury secretary Lawrence Summers. He said, that financially “Europe is a museum, Japan is a nursing home and China is a jail».

He may be right. China may really become a jail for the US dollar and current main global counterfeiter – the Federal Reserve.

……….

P.S. Dear Reader! I am very much interested in your opinion on the subject of this article. Please, write a comment or ask a question if you want to clarify something.

Yours,

Igor Chykalov

Comment

✚ Add comment