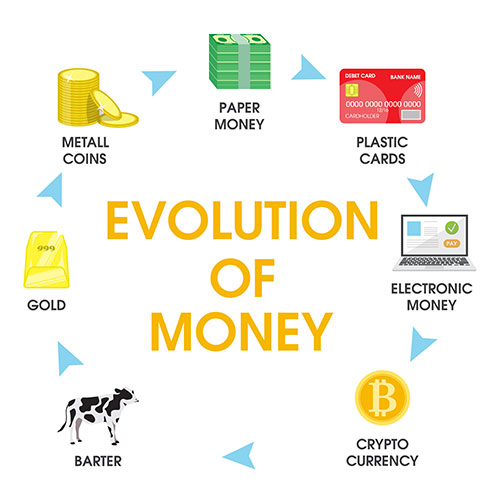

Cryptocurrency Is an Inevitable Step in the Evolution/Degradation of Money (part 4, excerpt)

Decentralized cryptocurrency is new global store of value.

Image from Pexels.com

Any real money must carry some intrinsic value which should not be easily taken off. That value is the invested labor (like in case of commodity money) or there should be the strict connection to something of value (like in case of representative money).

Fiat money can be devaluated without any efforts by the printing of banknotes by the central banks, thoughtless money lending (not just subprime lending) by commercial banks or just by signing the corresponding decree by the head of executive power. No labor which creates real intrinsic value is involved, just the devaluation of the labor which was previously put in.

National governments have disconnected their currencies from real value and lost the basis for mutual settlements of the accounts in the epoch of globalization. The US dollar is inconvenient global reserve currency because after its detaching from gold in 1971 the US has been constantly debasing its currency for the whole world via inflation targeting policy.

All major currencies are somehow exchanged for US dollar and for each other, but they are also fiat money being debased by their governments. Thus this bunch of surrogate currencies floats up and down, having very relative value and just adding a mess into calculations, accounting and ruining the savings.

The ordinary people and national elites obviously do not want their savings just to melt away, but everyone is usually unaware about government's purposeful efforts in creating inflation, perceiving it rather as a bad weather. However, everybody needs badly a real store of value - something which is able to withstand constant governmental debasing of money.

……….

You have read an excerpt from the article. The complete series of articles "Cryptocurrency Is an Inevitable Step in the Evolution/Degradation of Money" will be available for purchase as a separate book on my website becomethyself.com in a while.

Comment

✚ Add comment