Cryptocurrency Is an Inevitable Step in the Evolution/Degradation of Money (Excerpt)

Why do governments debase their currency?

Image from Pexels.com

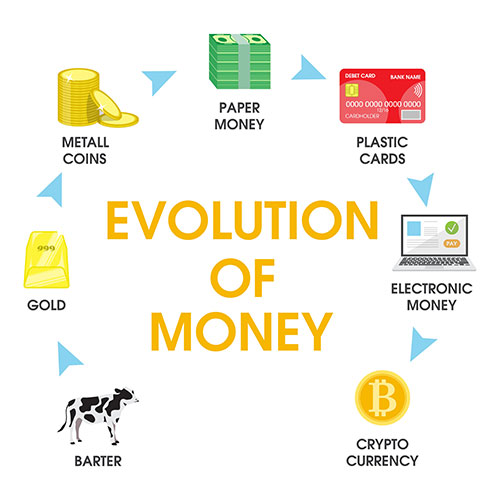

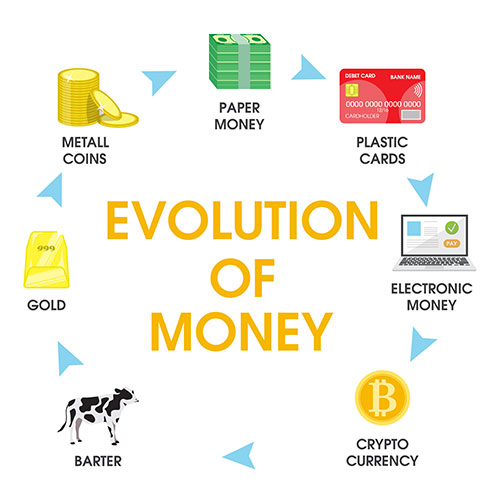

Before talking about cryptocurrency we need to define first what money is, where did it come from and why it is needed.

Wikipedia defines money as

"... any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The main functions of money are distinguished as: a medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

Money was historically an emergent market phenomenon that possess intrinsic value as a commodity; nearly all contemporary money systems are based on unbacked fiat money without use value. Its value is consequently derived by social convention, having been declared by a government… to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for "all debts, public and private"… . Contexts which erode public confidence, such as the circulation of counterfeit money or domestic hyperinflation, can cause good money to lose its value.

The money supply of a country comprises all currency in circulation (banknotes and coins currently issued) and… one or more types of bank money (the balances held in checking, saving… and other types of bank accounts). Bank money, whose value exists on the books of financial institutions and can be converted into physical notes or used for cashless payment, forms by far the largest part of broad money in developed countries.”

Sorry for the long quote, but every word in it is worth it. It is the base for understanding.

So, the most important functions of money are basically clear and need almost no explanation:

- a medium of exchange. A medium of exchange has to be divisible, easily and securely storable, transportable and widely accepted for payment for goods and services.

- a unit of account. A unit of account has to be stable in real value over time for correct accountancy.

- a store of value. A medium of store of value has to be able to retain its intrinsic value for a long while and hard to counterfeit.

- and sometimes, a standard of deferred payment. A medium of standard of deferred payment just like a medium of store of value has to retain its purchasing power in time.

Any item or verifiable record that fulfills these functions can be considered as money.

-------------------------------------------------------------------

Part 1. Evolution of Money: from Reality to Virtuality

Historically, the evolution of money has begun around 3000 BC from Commodity Money which had absolute intrinsic value by itself (barely, wine, salt, peppercorn, gold).

……….

You have read an excerpt from the article. The complete series of articles "Cryptocurrency Is an Inevitable Step in the Evolution/Degradation of Money" will be available for purchase as a separate book on my website becomethyself.com in a while.

Comment

✚ Add comment