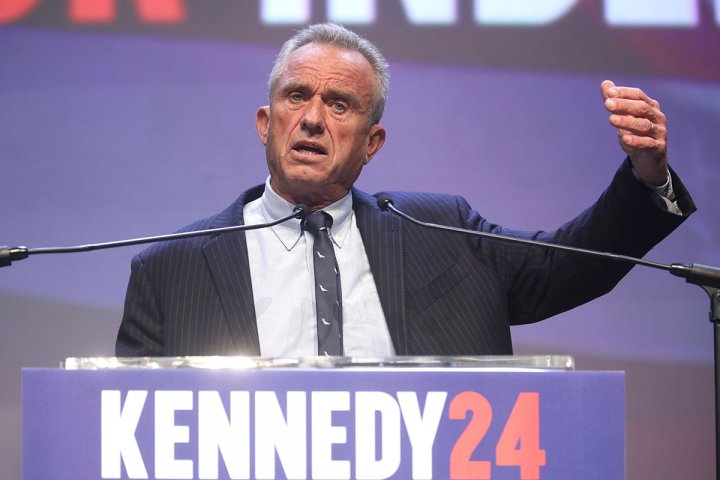

Trump and Bitcoin

The words of ultimate truth sometimes can come out

of the great liar’s mouth because he just chatters away

and no one pays attention to his words. And in vain.

of the great liar’s mouth because he just chatters away

and no one pays attention to his words. And in vain.

Collage from works of Gage Skidmore from Peoria, AZ, USA and Satheesh Sankaran, CC BY-SA 2.0 via Wikimedia Commons

In the end of July 2024, Mr. Trump made an unusual proposal. At a Bitcoin conference in Nashville, TN, he promised to establish a Bitcoin strategic reserve and make the US the "crypto capital of the planet."

Mr. Trump has surely heard about the interesting experience of El Salvador's President Nayib Bukele who adopted Bitcoin as legal tender in the country in 2021 and invested some of the country’s reserves in the cryptocurrency. This was a pure PR stunt: Mr. Bukele wanted to change the world's perception of El Salvador, and he did that. Mr. Trump seems to have decided to follow his example, but in my opinion, the main reason for his advocacy of Bitcoin is simply the desire to get some votes from members of the crypto community in the future presidential election rather than a genuine understanding of the economic implications of this truly revolutionary proposal and its consequences for the US and the whole world.

I have already written that the fundamental difference between the presidential candidates’ programs is that Mr. Trump proposes to destroy the existing order in the US (without explaining what he would build in its place though), while Mrs. Harris intends to maintain that order, assuring that it is good enough.

The introduction of Bitcoin as a legal tender can completely disrupt the existing financial system in the US and in the world since the USD is the world's reserve currency.

……….

Mr. Trump apparently doesn’t understand what he’s talking about.

Mr. Trump didn’t explain what he intends to do with Bitcoin which likely should involve many different nuances. He simply stated at the conference that he wanted to create a Bitcoin “strategic reserve using the currency that the government currently holds.” It’s not entirely clear, but if the Department of the Treasury starts buying Bitcoin, it would just drive up its price.

If Mr. Trump follows in the footsteps of El Salvador’s president and pushes for Bitcoin as legal tender in the US, that could crash the financial and other dependent markets in the country and beyond. I’m not an economist and can’t foresee all the consequences of introducing Bitcoin into official use, but I understand that it could trigger a financial tsunami that sweeps across the globe, completely altering its financial landscape, and the US dollar finally ceasing to be the world’s reserve currency. I’m intentionally avoiding diving into economic fantasies and details to keep the main point in focus.

Moreover, no one can devalue Bitcoin (it’s designed for that), and the US government would no longer be able to influence the country’s monetary policy by emitting extra money which is certainly not something the elites behind the government would welcome. Therefore, it might be easier for them to remove Mr. Trump (if they can see the implications of his innovation) than to accept such changes. With his Bitcoin proposals, Mr. Trump risks cutting the branch he and his billionaire friends are sitting on which indicates his misunderstanding of the issue. So I’m confident that Mr. Trump is going only to gain some votes from crypto fans and won’t make any real changes to the US financial system.

Interestingly, Mr. Trump spoke out against cryptocurrencies before and stated on social media that their “value is highly volatile and based on thin air.” Many economists expressed similar views, and Mr. Trump seemed to have echoed someone else's opinion. However, he has recently changed his stance on Bitcoin. Furthermore, Mr. Trump has launched recently a new venture for cryptocurrency trading named “World Liberty Financial.” That isn’t just talking, but an action which suggests that someone in his circle understands something about cryptocurrencies, and he is listening to that person.

……….

Bitcoin: what economists are afraid of.

I delved into cryptocurrencies a couple of years ago and came to certain conclusions.

As a result, I wrote a series of articles “Cryptocurrency Is an Inevitable Step in the Evolution/Degradation of Money” and posted excerpts online. If anyone is interested, give me your email in the comments to this article and I will send you the full version. If you like it, you can send me a few dollars as a «thanks» via the “Donate” button on my website.

Many economists consider Bitcoin a sham. No.

It is the future of money which, however, may not come due to the opposition of national banking systems and, in general, the elites of different countries. I have explained all this in detail in my series of articles.

Economists are worried about Bitcoin's "excessive volatility" and the fact that it is "backed by nothing."

This is not true.

……….

Bitcoin’s “excessive volatility.”

Even the gold changes its price depending on the amount of production and the demand in the world.

Bitcoin's excessive volatility is a consequence of the real capitalist conditions of its existence, since its cost is determined only by supply and demand in the real "capitalist" market. Federal Reserve and even US government have no power over Bitcoin, and this scares their economic consultants. Usually, the Federal Reserve manages monetary policy in the country, but here it can do nothing and even seems to be not needed at all. Who will manage money then? This is unusual and thus scary.

Bitcoin's extreme volatility will go away on its own over time if developed countries around the world start accepting Bitcoin as their legal tender instead of their national currencies. Yes, in that case the value of Bitcoin in fiat currencies will soar and then fluctuate at its new level, but that just means the increased demand is setting a new price for Bitcoin (now it is around $63K).

And I also want to point out that it's actually not bitcoin which going up in value, it's just fiat currencies that are going down because of their constant depreciation. The building of the global finances now has no foundation and stands on the sand of national currencies which are devalued by their national banks at a rate of at least 2% per year.

Fiat currencies are now losing the competition to decentralized cryptocurrencies and that’s fair and quite capitalistic. Why does this scare economists and governments of many capitalistic countries?

……….

Bitcoin is better backed than any fiat currency in the world.

To create Bitcoin, you need to spend some time and money on mining. JPMorgan estimates that the current mining cost for bitcoin miners was around $45K in May, 2024.

To create 1 million (or 1 billion) USD, the Fed simply needs to write this amount into the correspondent accounts of commercial banks, and they will distribute this money, for example, in the form of loans, devaluing the USD by the amount of the new-emitted money. National banks of different countries constantly create money from nowhere and put it into circulation. This process is correctly called «inflation» because it is literal "inflating" or "pumping up" the country's money supply with a «thin air». This money is backed just by government’s promises and decrees, that’s why it is called “fiat money”.

I called such money a “surrogate” because of its constant depreciation and inability to saturate the economy. To understand what a "surrogate" is, just compare what you could buy in the US for $1,000 10 years ago and now.

There is no any governmental body behind Bitcoin, so nobody can secretly add/withdraw some bitcoins into/from circulation (thus creating inflation/deflation) or abolish the currency at all. There is just a community of free Blockchain users and miners, where every issued Bitcoin is accounted for and recorded in an online "ledger", in which this record cannot be deleted. There is also a limit to the number of Bitcoins emitted. Currently, there are already about 20 million Bitcoins in the global circulation and when the ceiling of 21 million is reached, Bitcoin mining will cease because it will become unprofitable.

……….

Current fiat money and real «universal equivalent».

Let me remind you that the main reasons of existence of money are medium of exchange, unit of account and store of value. Money was invented by mankind around 5000 years ago as a "universal equivalent" for trade, so that it would be convenient to compare the cost of different goods and services. As a "universal equivalent", Bitcoin is not worse than any current fiat currency.

National governments have agreed with the people of their countries to accept their fiat money - dollars, euros, pounds, etc. - as payment for goods and services. These currencies can be bought and sold: the foreign exchange market is a free trade of virtual symbols ($, €, £, ₣, ¥, etc.) which is also regulated by supply and demand. So a bunch of fiat national currencies with relative value are linked together by relative exchange rates and just floats around somewhere in virtual bank space with relative purpose or meaning, being basically detached from any kind of absolute value like gold, oil, food or land because of the constant depreciation.

The finances of different countries and the global financial system are in decline mainly because they have no foundation - a universal equivalent that is not subject to depreciation. The US dollar and other national currencies are constantly being devalued by the national banks and cannot fulfill this role.

……….

Bitcoin can become a standard for the value of money and reliable store of value.

Wikipedia states that “A store of value is ANY (I.C.) commodity or asset that would normally retain purchasing power into the future and is the function of the asset that can be saved, retrieved and exchanged at a later time, and be predictably useful when retrieved.”

Current fiat money is not such a store of value because it is constantly devalued by the inflation targeting policy of national banks.

There is no longer a universal standard for measuring the value of money in the world which gold once was: in August 1971, Republican US President R. Nixon has uncoupled the USD from gold (so called «Nixon shock») in an attempt to combat inflation. By 1973, the current regime based on freely floating fiat currencies has become the new norm all over the world, and cash has been replaced by electronic money which are very easy to manipulate (there is no need even to print them).

Money at your bank account (and all fiat money today) is virtual — it's just electronic records in your bank's computers. About 70% of all payments in the U.S. are made with this virtual money using credit cards and other forms of electronic payment. During the coronavirus pandemic, many banks closed their offices and went online. Bitcoin was born in the online world, so why is it worse than fiat money?

Bitcoin is only worse for the governments - they will not be able to control Bitcoin payments and issue backed by nothing money (which is called counterfeiting, by the way), creating inflation and thereby devaluing their national currencies and citizens' savings.

Bitcoin and other decentralized cryptocurrencies (with the emission cap) are the only existing unique means to bring the finances of the US, other countries and the world financial system as a whole into relative order if a non-depreciating “universal equivalent” will replace the current system of constantly devaluing national currencies.

The inflationary economic theory of J.M.Keynes currently prevails in the world economy, although there are other economic ideas and schools. Most economists in the world, unfortunately, share Mr. Keynes's delusions, and the national elites of many countries have learned to extract great material benefits from his teachings. It is very profitable for them, so they will not allow even their president to introduce Bitcoin as a legal tender in the US.

……….

How does the politics make money on inflation?

I write about politics quite often, but politics is, in the words of V. Lenin, "the concentrated expression of the economics." In any country there is nothing, but the economy which creates the country's material wealth, and the politics which spends it.

The economy can earn a lot or a little. Politics can spend wisely or senselessly. Economics is more important than politics because if nothing is earned, there is nothing to spend.

Political struggle is actually a struggle for control over the country's economy, not for achieving the public good as many naive citizens think.

The US as a country seems to earn a lot: GDP in 2023 was $27.36 trillion, but it spent even more - $33.17 trillion in the same 2023. This means that the country is not developing, but degrading, and the elites use the funds given to them ineffectively, if not criminally. Such elites must be driven out. Both of them, since both Democratic and Republican governments have long been spending more than the people earn. However, it is extremely difficult to drive them out: they hold on tightly to power, blame each other for all the troubles, promise a lot, and people in the heat of political struggle do not see that the American elites are degenerating and working just for their own pockets, and not for the good of the nation.

US elites abuse people's money. How?

In short, they borrow money from the people, devalue it with the help of inflation, and after many years they pay back much less than they borrowed. Nice business, but this money is still not enough for their ambitions, and governments get into debt which they apparently do not intend to pay back. The idea of living in debt is also a legacy of Mr. Keynes.

Running into debts and depreciating of money allow the elites to outpace inflation with their incomes.

The elites have the exclusive access to other incomes (including corruption), other expenses (including the use of shell and offshore companies) and other investment opportunities.

Ordinary Americans do not have such opportunities, so they can't keep up with inflation and are getting poorer.

……….

Bitcoin can bring order to the world's financial system. Temporarily, like everything else in our lives.

The words of ultimate truth sometimes can come out of the great liar’s mouth because they just chatter away. People listen not to what Mr. Trump says, but how he says it, so almost no one pays attention to the meaning of his words, and in vain. Bitcoin (as probably the best of the existing decentralized cryptocurrencies) is the only way to bring order to the financial system of any country and the whole world. Bitcoin can fill money with intrinsic value and return one of its main functions - to be a long-lived store of value.

However, Bitcoin also has its own shortcomings which will definitely manifest somewhere in the future. What and when?

It depends on «when» Bitcoin will become «what» in the US. If only a bitcoin strategic reserve is created, this will just increase the price of Bitcoin. If the US recognizes it a legal tender in the country, this will increase its price much more and cause a financial (and therefore political) crisis in the US and around the world. However, later (if we manage to get out of the crisis), everything will be simple and clear with money and the economies of the surviving countries will function much easier and efficiently. For some time.

Why not always?

Because Bitcoin like everything in today's civilization is completely dependent on Internet and electricity which will one day disappear. That's when (but not before) Bitcoin will disappear also along with the apps and USB drives that store hot and cold keys to crypto wallets. But all fiat money will collapse earlier (during the crisis). I don't know when all this happens, but I know it will occur for sure.

What happens then?

At that point, money will complete its development/degradation cycle and return to the very beginning - to primitive barter. Why?

Because our civilization has passed the peak of its development and is coming to an end. The foundation of our civilization - the state — is self-destructing and everything is returning to its origin. There was only barter at the very beginning of our civilization around 5000 years ago. Money appeared later as a necessary universal, but only "equivalent". You can't eat it, drink it or pour it into a gas tank. Money is useless if no one wants to give real goods and services for it. I tried to explain this in a series of articles «Cryptocurrency...».

And World War III is already underway.

I have read somewhere that humanity's weapons in the next war after a nuclear war would be sticks and stones. Not right away, but overall the direction is shown correctly.

Everything moves in a circle, or rather in a spiral, but the spiral does not always go forward and upward. This is monitored by a huge Program (you can call it God or Cosmos) which we all live in and do not feel it. Think about how many species that once lived on Earth have become extinct. Recollect dinosaurs, for example.

Is the human species any better or worse?

Comment

✚ Add comment